As it prepares for the 2014 World Cup, Brazil hosted Mexico’s national soccer team in the Confederations Cup recently. The hosts won 2-0 and clinched a spot in the semifinals of the Confederations Cup. This wasn’t the first victory of sorts that Brazil has secured over it’s Latin American rival: in May the World Trade Organization elected Brazil’s Roberto Azevedo to lead the body over Mexican Herminio Blanco. In a way this race best defined the terms of the rivalry between Mexico and Brazil and what defines their more broad motives in Latin America. Mr Blanco is known as a liberal advocate of free trade policy; he negotiated the country’s entry into the North American Free Trade Agreement (NAFTA). While Roberto Azevedo doesn’t necessarily contradict this view, Brazil has more protectionist trade policies than Mexico and Mr Azevedo was seen as more of a WTO insider than Mr Blanco. While the candidates’ respective nationalities certainly was not the deciding factor in this race, it is an example of the type of role that both nations compete for, both regionally and globally.

(Source)

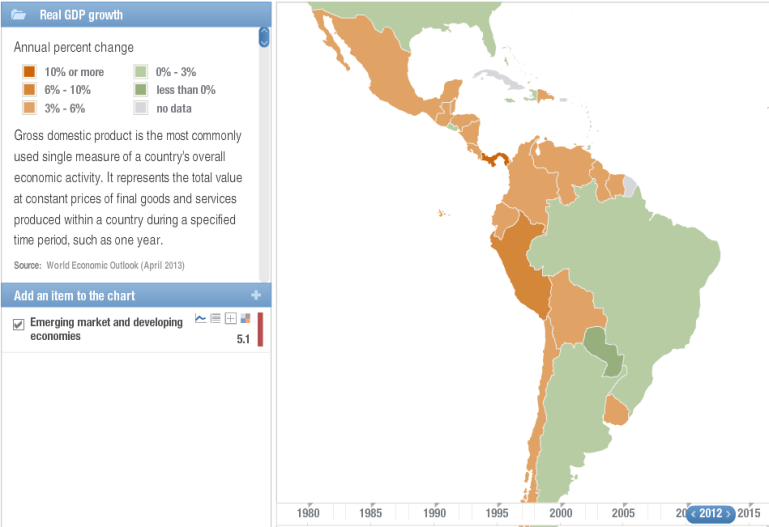

While the WTO functions as a global body for deliberations on matters of trade, Latin America has no regional equivalent. Instead, there are various regional trade blocs such as Mercosur and the Andean Community of Nations (CAN) that seek to both increase regional trade (between member states) and global trade with their organization. Despite being the older of the two, CAN has recently lost influence, with Venezuela leaving in 2006 to join Mercosur. Bolivia has also recently applied for membership in the larger Mercosur trade bloc. These movements have empowered Mercosur, whose members now includes Brazil, Argentina, Venezuela, Uruguay, and Paraguay (on a suspended membership). These countries had a combined economic output of $3.59 Trillion in 2012, with Brazil having the largest single economy by far:

(Source)

Despite these countries having a reputation as fast-growing emerging markets, the trade bloc averaged just 2.18% GDP growth last year, with lower than expected growth in Brazil and Argentina pushing the average down. This is surprising because in the year prior the bloc averaged 5.16% in 2011, and while Brazil’s economic growth has been slower lately it is still a nation that Jim O’Neill compared favorably with China and India when he first proposed the concept of BRICs. So where does Mexico fit into all of this? Mexico is neither a member of Mercosur nor has it attempted to join it. Instead Mexico helped found The Pacific Alliance, a trade bloc that was created in 2012 and now includes Mexico, Chile, Colombia, Costa Rica and Peru. Combined these countries had a smaller but still considerable GDP of $2.96 Trillion in 2012. Like Brazil in Mercosur, Mexico’s economy looms large within the Alliance:

(Source)

If 2012 was a difficult year for Brazil and Mercosur the opposite was true of Mexico and the Pacific Alliance. The five nations averaged 4.94% growth last year, and 5.51% in 2011, and the Pacific Alliance actually accounted for more international trade than than Mercosur in 2011. When you break this trade down there are a number of interesting findings:

(For a country-specific breakdown refer here)

Despite the Pacific Alliance having an 18% smaller economy than Mercosur, the Alliance had 9% more total trade in 2011 (Source). Beyond this there are a few other important things to point out: the Pacific Alliance had more overall trade than Mercosur, but the two blocs had very different terms of trade. While Mercosur posted a narrow trade surplus of +1.9% (meaning they exported more than they imported) the Pacific Alliance posted a trade deficit of -1.3%. This comes despite the Alliance having more total exports ($586 Billion vs $505 Billion). When you break down these figures further, the relative strengths or “comparative advantage” of each country is exposed:

Mexico has the largest total exports by a long shot; despite having an economy that was 16% smaller than Brazil’s in 2011, its exports were 11% larger in that year. But beyond having a different level of trade, the composition of Mexico’s trade is quite different: 70% of its material exports were manufactured goods, while Brazil’s material exports are fairly evenly distributed between agriculture, fuels and mining, and manufacturing. More examples of comparative advantage come from other countries in these blocs: Venezuela has the fourth largest exports of this group yet its travel industry is less than half the size of smaller Costa Rica. Instead, Venezuela exports vast amounts of oil (categorized as fuel and mining goods), which makes up 93% of its material exports. Chile’s exports are similarly dominated by this category, with fuels and mining making up 62% of material exports. While Colombia’s underground wealth is worth $37 Billion, Argentina’s agriculture sector is worth even more in annual exports. All of these country specific findings are intriguing by themselves, but the overall trend that divides the two blocs is clear: the Pacific Alliance both trades more on average and more overall than Mercosur.

Beyond trade, the two blocs have political differences that are as notable as their trade differences. Mercosur is controlled by several charismatic and leftist governments, from the legacy of Hugo Chavez in Venezuela to Mrs. De Kirchner’s Argentina. The addition of Venezuela in particular has caused some analysts to ponder whether Mercosur exists solely as a trade bloc or if it has a more political role. “Mercosur is no longer about trade,” Johns Hopkins’ Riordan Roett, told the Council on Hemispheric Affairs. “The organization is more and more political and to some degree anti-American.”

Others have pointed out that the bloc hasn’t really done much when it comes to trade: the bloc has only signed regional trade agreements with Israel, Egypt and the Palestinian Authority. The protectionist policies used by some of the bloc’s members have also been criticized, sometimes by surprising sources. Uruguayan President José Mujica allegedly said protectionist policies under Argentine president Cristina Fernandez de Kirchner are “even worse” than they were under her deceased husband Nestor Kirchner. Whether or not this particular allegation is true, the bloc has had a trade imbalance that has heavily favored Brazil over other members: from 2002 to 2011 Brazil had a trade surplus of $36.8 Billion against other Mercosur members (Venezuela was not yet a member). While this might not be connected to protectionist policies and the imbalance has gotten smaller over time, concerns remain over trade imbalances, particularly in Venezuela, which had a $4 Billion trade deficit with Brazil last year.

(Source)

While the Pacific Alliance has not faced the same scrutiny, it’s pro-American orientation has been not gone unnoticed. The Alliance’s level of trade with the US is incomparably higher than Mercosur’s, Mexican-US trade alone dwarfs all trade between Mercosur and the United States. Beyond trade, the Alliance includes right-wing governments that have very close relations to the United States, particularly in Colombia and Mexico. The Pacific Alliance’s connection to American foreign policy has been criticized as unnecessarily dividing Latin America to its own detriment as America seeks to reaffirm its dominance in the Pacific.

Specifically, the Pacific Alliance’s support for the Trans Pacific Partnership (a trade treaty) has been criticized. The treaty has been called (both negatively and positively) the NAFTA of the Pacific. Currently only Chile, New Zealand, Singapore, and Brunei are the only full members but there is a large list of countries negotiating to enter in: Japan, Canada, America, Australia, Vietnam, Malaysia, Mexico, and Peru have all begun negotiation talks, and Costa Rica and Colombia have expressed interest in entering the treaty. With all of the Pacific Alliance members either seeking to be or already members of the treaty, where does opinion stand in Mercosur on the Trans Pacific Partnership? While the bloc itself has not condemned the treaty, it is perhaps telling that Brazilian Roberto Azevedo (the director-in-waiting to the WTO) himself criticized the treaty and said that it could derail broader trade liberalization globally.

While it seems unlikely that the two blocs will form into military alliances, dividing Latin America like the Warsaw Pact and NATO divided Europe, there are reasons to care about these developments. Latin America was itself badly hurt by the conflicts on the Cold War, and while this new division between the slightly more statist Mercosur and the market-led Pacific Alliance might not resemble the bad old days, it could set the region back. Most importantly, by dividing the region along political lines, the rival camps may impede regional integration that is needed to ensure both stability and prosperity across Latin America.